Every expert started out as a novice. So, with this article, we hope to encourage aspiring investors to cast aside their fears and journey into the world of investing. It also seeks to highlight some timeless principles, which will help newbies deal with the uncertainties in the world of investing.

I have been investing for the past decade and I can’t proclaim to be an expert. In fact, I don’t think anyone can claim he is one. Even the best investor of our generation – Warren Buffett, admitted that he made a number of mistakes in his decades of investing career. I have made a fair number of mistakes along the way too. Some mistakes are more costly than others, but it is important that we learn valuable lessons. So, if the God of Investing can be wrong, we should not be too harsh on ourselves as long as we can live to fight another day!

Warren Buffett has many timeless quotes. Let’s look at a few key ones. I hope they will provide you with some inspiration and guidance, whether you are an aspiring investor or a relatively experienced one.

Do not save what is left after spending, but spend what is left after saving

People must realise that to build wealth, you must start to save money. And more importantly, ensure that the savings are put to work hard to grow the nest. The key is to build the habit over time, review your monthly spending and start to trim unnecessary expenses. Even a $100 a month that goes into good investments, when compounded over a long period of time, works wonders. We should develop the habit of delayed gratification and work towards the goal of financial independence.

Rule #1 – Never Lose Money; Rule #2 – Never forget rule #1

This should not be mistaken as being afraid to take risk. However, we want to take calculated risk vs return and ensure we end up positive in the long run. Thus capital preservation is key to ensuring that we have the means to grow our wealth.

The following table illustrates the Math of Recovery from a Potential Loss:

| Starting Balance | Loss % | Ending Balance | Gain required to be back to initial |

| 1000 | -5% | 950 | 5.3% |

| 1000 | -10% | 900 | 11.1% |

| 1000 | -20% | 800 | 25.0% |

| 1000 | -50% | 500 | 100.0% |

| 1000 | -99% | 10 | 9900.0% |

Some investors may not realise that if you lose half your capital, you need to make 100% return on your next investment in order for you to recover your original investment. That is akin to trying to climb out of a deep abyss and requires a lot of skill!

When you next face a bad investment, remember the rule and be ready to cut loss.

Do not put all your eggs in one basket

Diversification allows you to weather cyclical times of different stocks. What happens if you are wrong with the investment thesis? What happens if the macro factors that affect some of your stocks have changed, while others remain unaffected?

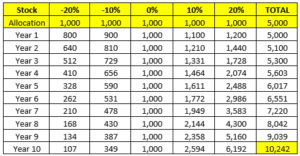

The table below illustrate the importance of diversification. Assume an equal amount of $1,000 invested in 5 stocks with returns ranging from -20% to +20%. In this case, you are only right 2 out of 5 times (2 stocks with +10% and 20% returns). What do you think is the total return of the portfolio over a period of 10 years ?

You may be surprised that your investment will double to $10,000 even though you are only right 2 out of 5 times! Hence, you don’t need to be overly focused on being right all the time in picking the right stocks. In fact nobody is right 100% of the time.

The magic formula to long term success is to make fewer mistakes, let the winners compound and cut loss on the losers.

Price is what you pay, value is what you get

Don’t focus on price, but the business

Investors are always tempted to constantly check the prices of their stocks. What they don’t realise is that price only reflects the perceived value of the stock and changes almost every second. It is also a reflection of the demand and supply for the stock, with different views between buyers and sellers. Prices go down when there are more sellers than buyers. Conversely, prices go up when there are more buyers than sellers. Sometimes, prices change due to issues that the company is facing – declining profits, reduced market share from competition, fraud etc. Other times, there is no change in the the company’s fundamentals. For example, Coca-Cola continues to sell millions of bottled Coke around the world everyday. There may not be any significant changes in its business even though its share price can fluctuate all the time.

Quantitative and Qualitative analysis

The key to investing is to start by assessing the value of the company. You can use both quantitative and qualitative measures in your assessment. Quantitative measures can be assessed by examining the company’s key financial information. You can do so by looking at the company’s Balance Sheet, Income and Cashflow Statements in its Annual Reports. From the assessment, we can determine the “health” of the company. This will help us find out if it is highly leveraged, the stability and growth of its earnings, and whether it has sufficient cashflow and liquidity to meet its short and long term obligations etc. Qualitative measures include the key management and their vision, whether the company has the “moat” to protect its competitive advantage.

You can use different tools like Discounted Cashflow models or looking at the Price/Book or Price/Earning ratios to determine the fair value of the company. After that, you can then objectively evaluate whether the company is undervalued, overvalued, or fairly valued, relative to the current stock price. Warren Buffett is a shrewd investor who only picks undervalued businesses.

In conclusion, I hope I have shown you some light as you begin your journey into the world of investing. Continue to learn and apply the basic principles mentioned above, and hopefully your journey will be more smooth sailing.

Recent Comments